Assume a world where your car, your phone, and the entire power grid run on clean energy. Now, imagine that this future hinges on a single, shiny metal that has been in your pocket change for centuries. That metal is nickel. And if you want to understand the high-stakes game of clean tech, electric vehicles, and global economics, you need to know it through the lens of FintechZoom.com nickel.

This isn’t your grandfather’s industrial metal. Nickel has become a star player, a critical component in the lithium-ion batteries that power everything from Teslas to iPhones. Its journey from a simple alloy to a geopolitical hot potato is a story of technology, finance, and sustainability colliding. So, let’s dive into why fintechzoom nickel coverage is more relevant than ever and what it means for you as an investor and a citizen of the world.

Why Nickel is Suddenly Everyone’s Best Friend

For a long time, nickel was best known for making stainless steel, well, stainless. It was a stable, if unglamorous, market. But then, the electric vehicle (EV) revolution hit the accelerator.

The Battery Connection: The secret sauce in most high-performance EV batteries is a compound called Nickel Manganese Cobalt (NMC). The more nickel you pack into the cathode of a battery, the higher the energy density. Simply put, more nickel means a car can drive farther on a single charge. Automakers are desperately competing for “range,” and nickel is the key to winning that race.

Think of it like this: if an EV battery were a sports team, nickel would be the star quarterback. It’s the most important player on the field, responsible for the biggest plays. This shift has turned the nickel market on its head, creating a surge in demand that has investors and analysts on Fintechzoom paying very close attention.

Breaking Down the Nickel Market: Prices, Players, and Politics

Understanding the nickel market isn’t just about watching a ticker tape. It’s a complex web of geology, geopolitics, and global supply chains.

Where Does Nickel Come From?

Nickel is primarily mined in two forms:

- Class 1 Nickel: This is the high-purity stuff (over 99.8% pure) that is essential for batteries. It’s harder and more expensive to produce.

- Class 2 Nickel: This includes lower-purity products like ferronickel, used predominantly for stainless steel.

The crunch is in Class 1 supply. The major players are:

- Indonesia: The world’s largest producer, thanks to massive investments in processing plants.

- Philippines: Another major supplier in Southeast Asia.

- Russia: Home of Norilsk Nickel, a mining giant, whose supply has been complicated by geopolitical tensions.

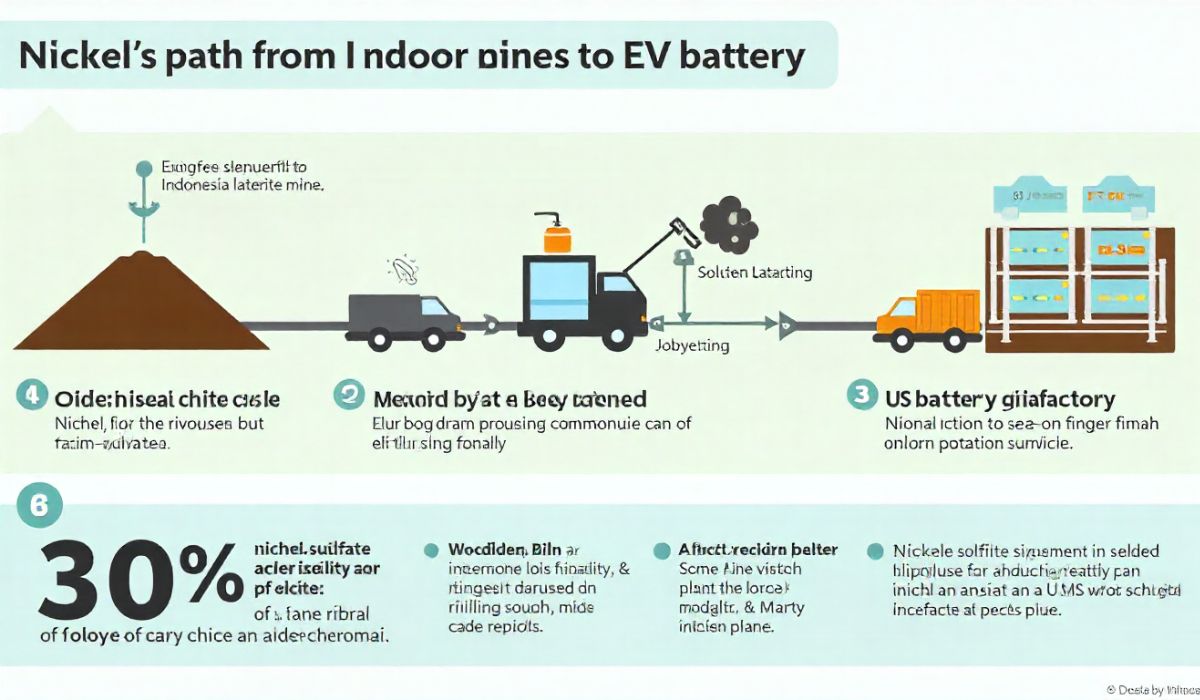

Here’s a quick look at the supply chain dynamics:

| Stage | Key Activity | Major Challenge |

| Mining | Extracting nickel ore from the earth. | Environmental concerns, especially deforestation in Indonesia. |

| Processing | Refining ore into usable metal (Class 1 or 2). | Energy-intensive; creates significant carbon emissions. |

| Manufacturing | Producing battery precursors and cells for EVs. | Securing long-term, ethically-sourced supply contracts. |

What Moves Nickel Prices?

If you’re following fintechzoom nickel prices, you’re watching a market influenced by:

- EV Production Forecasts: When Tesla or Volkswagen announces ambitious new targets, nickel prices often jump.

- Indonesian Policy: As the top producer, Indonesia’s export taxes and mining regulations can swing the market.

- Geopolitical Events: Sanctions or conflicts in key producing regions disrupt supply.

- The Dollar: Like most commodities, nickel is priced in U.S. dollars, so a strong dollar can make it more expensive for other countries to buy.

Read also: FintechZoom.com Bitcoin: Your Guide to the Pulse of Crypto

How FintechZoom Covers the Nickel Beat

So, where does Fintechzoom.com fit into all this? They act as a crucial aggregator and analyzer of information. They don’t just report the price; they connect the dots.

Fintechzoom’s coverage typically includes:

- Real-time and historical price charts for nickel futures.

- Analysis of major nickel mining stocks like BHP Group, Norilsk Nickel, and Glencore.

- News on supply deals between automakers and mining companies.

- In-depth articles on market trends, such as the push for “green nickel” (nickel produced with lower carbon emissions).

For an investor, this holistic view is invaluable. It helps you see the bigger picture beyond daily price fluctuations.

Investing in Nickel: Your Options Explained

You don’t have to go buy a physical ton of nickel to get in on the action. There are several ways to gain exposure, each with its own risk profile.

- Nickel Futures and ETFs: For direct, albeit complex, exposure to the metal’s price. Examples include futures contracts on the London Metal Exchange (LME) or ETFs that track nickel.

- Mining Stocks: Buying shares of companies that mine nickel. This is a popular way to invest, but it ties your fortune to a single company’s management and operational success.

- Battery and EV Companies: An indirect play. By investing in Tesla, BYD, or battery makers like LG Chem, you’re betting on the entire ecosystem that consumes nickel.

A Word of Caution: The nickel market is notoriously volatile. Remember the LME Nickel Short Squeeze of 2022? Prices skyrocketed over 250% in a matter of days, leading the exchange to halt trading—an unprecedented event that showed just how wild this market can be. Always do your research and consider your risk tolerance.

The Dark Side: Environmental and Ethical Considerations

The race for nickel isn’t without its problems. The massive expansion of mining in Indonesia has raised serious environmental alarms.

Deforestation and Pollution: Much of Indonesia’s nickel is processed using coal-fired energy, creating a paradox where a metal for a “green” revolution is fueled by a dirty one. Furthermore, the disposal of mining waste (tailings) into the ocean has been a major point of contention.

This has led to a growing demand for sustainable and ethically sourced nickel. Companies are now under pressure to prove their supply chains are clean, which could create a premium market for “green nickel” in the future.

The Future of FintechZoom Nickel: What’s Next?

The trend is clear: demand for nickel is only going up. But the future will be shaped by a few key questions:

- Can supply keep up? New mines take years, sometimes decades, to develop.

- Will new battery technologies reduce nickel reliance? Some companies are exploring lithium-iron-phosphate (LFP) batteries, which use no nickel or cobalt. However, for high-performance vehicles, NMC batteries are likely to remain dominant.

- How will the industry become greener? The push for carbon neutrality will force the mining sector to adopt cleaner technologies, which could add to costs but also create new opportunities.

Your Takeaway: 3 Things to Watch

The story of nickel is a perfect example of how old-world commodities are being reinvented by new-world technology. To stay ahead of the curve, keep an eye on:

- EV Sales Data: This is the ultimate driver of demand.

- Indonesian Government Policies: They hold the keys to the supply kingdom.

- Breakthroughs in Battery Tech: Any news that changes the nickel-to-cobalt ratio, or eliminates nickel altogether, is a market-moving event.

The next time you see a silent EV glide by, you’ll know there’s a fascinating, volatile, and critical story behind it—a story you can follow closely on Fintechzoom.com.

What do you think will be the biggest challenge for the nickel market in the next five years? Share your thoughts below!

FAQs

1. What is the current price of nickel?

Nickel prices are highly volatile and change daily based on market conditions. For the most accurate, up-to-date price, check the real-time charts on financial news sites like Fintechzoom.com.

2. Why is nickel so important for electric car batteries?

Nickel increases the energy density of lithium-ion batteries. This means batteries with more nickel can store more energy, allowing electric vehicles to travel farther on a single charge.

3. Which country has the most nickel?

Indonesia is currently the world’s largest producer of nickel, followed by the Philippines and Russia. Indonesia’s dominance has grown significantly in recent years due to large-scale investment in processing infrastructure.

4. Is investing in nickel a good idea?

Nickel has strong long-term growth potential due to its role in the EV revolution. However, it is a very volatile commodity, and investing carries significant risk. It’s crucial to research thoroughly and consider diversifying your investments.

5. What are the main types of nickel?

The two main categories are Class 1 (high-purity, over 99.8% nickel, used for batteries) and Class 2 (lower purity, like ferronickel, used primarily for stainless steel).

6. What was the LME nickel short squeeze?

In March 2022, the price of nickel on the London Metal Exchange (LME) exploded by over 250% in just a day, largely due to a short squeeze. The situation was so extreme that the LME took the unprecedented step of suspending trading and canceling billions of dollars in trades.

7. What is “green nickel”?

“Green nickel” refers to nickel that is produced with a significantly lower carbon footprint. This can involve using renewable energy for processing or implementing more sustainable mining practices, and it is becoming a key focus for environmentally conscious automakers.

You may also like: FintechZoom.com DAX40: Your Guide to Germany’s Blue-Chip Index